Transitioning Ownership of Your Health Care Organization

By James Rothenberger

Vice President

Moss Adams Capital LLC

Original Publish Date: May 9, 2017

Whether your health care organization is physician owned, institutionally owned, partnership owned, or individually owned, preparing to transition the ownership of an organization will help determine the best time to move forward with a potential transaction.

The purchase and affiliation of health care organizations continues to take an above average share of the global mergers and acquisitions (M&A) market. Over the past three years, health care M&A has taken a 20 percent share of all M&A activity, according to Pitchbook. It consisted of only a 14 percent share from 2006–2013. Because of this increased M&A activity, health care organizations are contacted regularly by potential purchasers, so it’s smart for a health care organization to be prepared for a potential ownership transition—and to know what purchasers look for in an acquisition.

If an organization is potentially looking to affiliate, partner, or sell, preparing for that change is becoming increasingly important as uncertain regulatory changes and challenges continue to occur in health care.

Acquisition Attributes

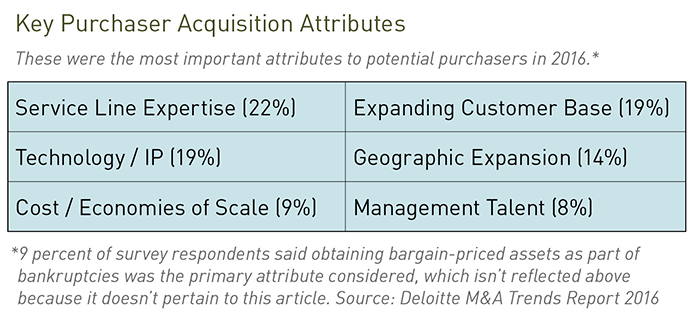

Buyers, including traditional strategic purchasers as well as private equity firms, frequently look for geographic expansion opportunities or service-line expertise in the targets they consider acquiring. However, there are several other key acquisition considerations to keep in mind, including:

- Management team quality

- Technology systems and intellectual property related to an exclusive service-provider relationship

- Economies of scale and customer base expansion

An organization’s quality and degree of preparation in these areas will materially impact the price, terms, and conditions they’ll be able to realize when they sell.

How to Prepare

There are seven key steps all health care organizations can take to prepare themselves for a potential affiliation or sale to another party:

Consider Quality of Management (QOM)

A company’s most valuable asset is frequently its management team. Prior to engaging in discussions with a potential buyer, identify and build up a second-in-command, and consider securing other key employees to the business. Frequently, organizations can use their CEO, CFO, medical director, vice president of product, or clinical leaders to build their core management team and management bench.

Articulate Growth Strategy

Buyers are looking for growth, even in the case of consolidation and economies of scale. They want to know what opportunities have been identified, and how an organization plans to approach them. To facilitate this, an organization can write a financial and strategic plan that presents and features geographic expansion, service-line expansion, product opportunities, or payer opportunities in its market to help buyers get excited about the potential for acquisition.

Understand the Organization’s Value

Knowing the value of an organization, and the drivers of that value, will help you more objectively evaluate transition alternatives. Many of the qualities buyers look for in an organization also add value to it. Find what these are and incorporate them into the organization’s growth strategy.

Prepare for Due Diligence

Although the due diligence process is standard among buyers, health care organizations are increasingly coming to understand the value of performing due diligence on the sell side as well. Due diligence is an intensive exercise any buyer will want to spend significant time on.

Organizations can prepare for this process by beginning to gather due diligence information and documentation and understanding key financial and operating trends. This will help address the organization’s strengths and weaknesses and instill confidence in buyers.

Pulling this information together in a data room of documents that are prescreened, reviewed, and presented in a clear fashion can remove months from the M&A timeline, improve the chance of a successful outcome, and allow an organization to focus on running its business and serving patients and customers.

Research Potential Tax Implications

It can be tempting to forgo consideration of potential tax or financial issues when pursuing the sale of a business, but examining the risks in the early stages of a transaction is a valuable bargaining chip—and a chance to boost value. Sellers often hesitate to incur the expense associated with sell-side tax due diligence even though they have as much to gain from the process as buyers.

Without due diligence, promising deals can quickly go sideways when buyers discover tax surprises during their own due diligence process, creating uncertainty for both parties during the sale and putting the seller in a defensive position instead of a proactive one. The due diligence process is also a chance to understand the tax implications of a sale, including alternative structures and how they may impact a transaction.

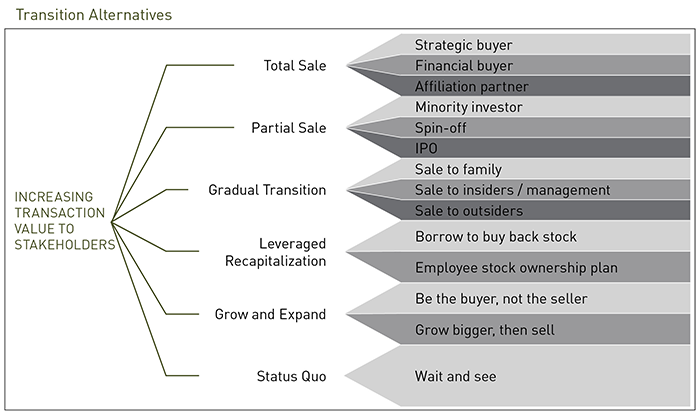

Evaluate Transition Alternatives

The buyer universe shifts depending on the type and structure of your desired transition. Is the management team pushing for a sale, or are the providers? Is the management team looking to exit the business completely, or would they like to stay on with the new partner? Determine what the transition options are and which options align best with key individual and organizational goals. The framework provided below can be helpful in evaluating what an organization’s options are for a transition.

Look at Transaction Timing

Preparing to transition the ownership of your organization and answering these questions can help an organization determine the appropriate time to consider transitioning ownership:

- Does a transition at this time align with the organization’s goals?

- Does the team have the capacity to manage both the business and a transition event?

- Are there sufficient buyers for the organization yet?

These questions will help clarify organization objectives and set the stage for a more successful transaction process. Understanding and preparing for these steps will also help make an organization more attractive to potential buyers. This creates the potential, as the seller, to maintain more leverage during negotiations.

We’re Here to Help

The M&A process is complex and time-consuming, with many constantly moving and overlapping variables. For more insight on preparing your health care organization for a potential M&A transaction, contact your advisor.

James Rothenberger is a vice president with Moss Adams Capital LLC. He supports middle-market business owners with M&A transactions. He also supports Moss Adams Capital’s Health Care Services banking group. You can reach James at (206) 302-6777 or james.rothenberger@mossadams.com.