Republicans Approach Medicaid Reform as a Balancing Act

By Christopher Bell, CPA

Senior Manager, Moss Adams LLP

By Tony Andrade, CPA

Partner, Moss Adams LLP

Original Publish Date: March 7, 2017

Republican leaders in Washington, D.C. looking to reform the Medicaid system will be trying to balance three competing priorities:

- Rein in costs

- Eliminate unpopular fees and taxes used to pay for the Affordable Care Act (ACA)

- Prevent the federal deficit from ballooning

In this article, we provide a brief overview of how the Medicaid program works; the impact of Medicaid expansion, including pre- and postexpansion Medicaid enrollment numbers; and Republicans’ proposed solutions.

How Medicaid Works

Medicaid spending topped $500 billion in 2015, and it’s projected to approach $1 trillion by 2025, according to the Centers for Medicare & Medicaid Services (CMS).

When President Lyndon Johnson signed the Medicaid bill into law in 1965, it was supported by roughly half of the Republicans who voted on it. It’s unlikely he knew the program—which cost less than $1 billion in 1966, according to Medicaid Spending: A Brief History by John Klemm (CMS, 2000)—would become what it is today.

In stark contrast with the ACA, the Medicaid program was passed with bipartisan support, which still stands today. While there are competing visions for how Medicaid should operate, the 2016 Republican platform made it clear both political parties remain steadfast in their support for continuing the program.

The Medicaid program gives states the flexibility to create health care programs for targeted groups, as long as those programs meet federal guidelines. Targeted groups include Supplemental Security Income recipients and low-income individuals and families, in particular:

- Families with children

- Pregnant women

- Seniors who fall within the income thresholds as well as those who can demonstrate their assisted living expenses reduce their disposable income to the poverty level

- Individuals with disabilities

Wealthier states receive 50 percent of their funding through the federal government, while states with lower income per capita can receive as much as 73.1 percent of their funding from Washington, DC.

Medicaid Expansion

When the ACA was passed in 2010, the federal government incentivized states to expand their Medicaid programs by promising to pay 100 percent of expansion costs for adoptees, a funding level which would eventually decrease to 90 percent by 2020. The goal of the expansion was to:

- Increase the definition of low income to 138 percent of the federal poverty line

- Cover all low-income adults, including those without children

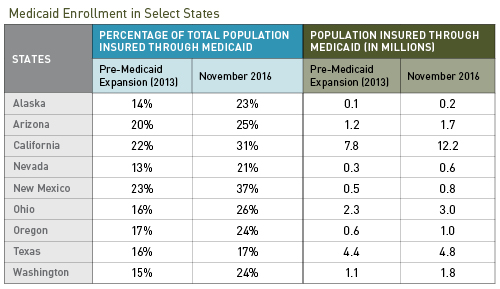

Ultimately, only 19 states declined to expand their Medicaid programs, bringing the total number of individuals covered by the program to approximately 75 million—roughly 23 percent of the total US population—as of November 2016. In California in particular, more than 30 percent of its population is now enrolled in the Medicaid program, according to the Kaiser Family Foundation.

Rising Costs

The program’s rising cost can be deceiving. It isn’t driven by the children and working adults who make up the majority of the enrollees. Instead, it’s largely driven by health care services provided to those with disabilities and seniors, particularly in assisted living arrangements, according to the Kaiser Family Foundation.

Potential Republican Solutions

Conservative leaders in Washington, D.C. would like to control costs by ensuring greater financial accountability at the state level. They believe there’s little incentive for state programs to rein in spending when the federal government pays at least half of all standard program costs and 90 percent or more of Medicaid expansion costs.

Fixed Federal Payments

One proposed solution is to make federal payments fixed and shift the risk of rising costs or poorly controlled spending entirely to the states. This could be accomplished through:

- Block grants. A fixed dollar amount is given to states on an annual basis.

- Per capita grants. A fixed dollar amount for each enrollee is provided annually to states.

Previous Republican proposals have limited the growth of these grants to something close to the inflation rate, which is currently in the mid-2 percent range. This is far lower than the projected annual health care growth rate of nearly 6 percent, as described by Shefali Luthra in The Skinny on Block Grants—The Heart of the GOP’s Medicaid Plan (CNN, 2017).

This might not make a huge difference in one year, but the compounding effect of funding increases that are less than half the projected health care growth rate will put considerable pressure on states to control costs, reduce benefits, and limit enrollment.

Medicaid Expansion

More controversial is the way Medicaid expansion under the ACA will be handled. In February 2017, Republican leaders unveiled a provision to eliminate the 90 percent federal funding of expansion costs and replace it with:

- 50 percent funding for wealthier states

- Potentially more than 50 percent for states with lower income per capita

While some states may choose to bear the brunt of the potential 40 percent funding gap, it’s likely that many won’t.

At a time when congressional conservatives need almost unanimous support to pass health care reform, nearly 40 percent of the 52 Republican senators come from states that expanded their Medicaid programs and may resist efforts to cut federal funding to the program.

Taxes

A theme of the 2016 Republican campaign was eliminating many of the unpopular taxes used to pay for the ACA:

- Net investment income tax

- Medicare surtax

- The so-called Cadillac tax

- Medical device excise tax

- Patient-centered outcomes research trust fund fee

- Higher maximum individual tax rates

While getting rid of taxes may be popular, it will also put pressure on the rising deficit—a key issue for many conservatives.

On February 16, 2017, Speaker Paul Ryan presented a summary of what the Republican health care proposals will look like but didn’t include information on how they would be paid for. It may be challenging to gain support from Republican members of congress to offset the cost of health care reform through taxes and fees.

What’s Next

Medicaid continues to be a vital program to millions of Americans. Many of the states likely to be hit hardest by block-grant funding of Medicaid are wealthier blue states that didn’t vote in favor of President Donald Trump in the 2016 election—including Massachusetts, California, and New York. These states expanded Medicaid with the promise of federal funding, but if block grants are implemented at traditional reimbursement rates, their federal funding would decrease significantly. Impacted states will need to decide whether to:

- Reduce benefits

- Reduce enrollment

- Raise taxes to fund existing beneficiaries

- Reduce payments to health care providers and facilities

These options will be politically challenging and may have a significant impact on how low-income constituents access basic health care services.

Chris Bell, a CPA, has practiced public accounting since 2005. His sole focus is providing tax and business planning services to physician groups in Northern California. Chris can be reached at (916) 503-8164 or chris.bell@mossadams.com.

Tony Andrade, a CPA, has more than 23 years of public accounting experience working with health care and insurance organizations. He manages audits and provides consulting services to health care and insurance organizations. Tony can be reached at (503) 478-2287 or tony.andrade@mossadams.com.